This month:

Expert investment views:

The investment potential of India is highlighted as the country’s international trade links flourish

One expert explains why their firm is underweight equities, but not as much as it has been in the past

The alarm is sounded for a potentially nasty corporate earnings surprise coming later in the year

Featuring this month’s experts:

1. All eyes on India

India this year is chairing the G20 meetings in the run-up to the summit on 9 September in Delhi. In the communique released after the meeting of G20 finance ministers last month, members agreed to disagree about Ukraine. This week brought the foreign ministers of the US and Russia together in the same room for the opening of their conference but is unlikely to result in serious dialogue about the war or an agreed G20 position.

India is following a policy of having good links and trading relationships with both the China/Russia-led bloc and with the US/NATO-led bloc. So far, they have succeeded in maintaining their neutral stance on Ukraine and other issues that divide the two global coalitions. Prime Minister Narendra Modi urges peace talks and a negotiated settlement on the combatants and their supporting states.

Chancellor Olaf Scholz’s recent visit saw Germany seeking improved trading arrangements with the emerging Asian giant. This was a reminder of how India is now being courted by the powers of the globe

India under Mr Modi has sought to grow rapidly, seeking to raise living standards and effect a smooth transition away from so many low-paid agricultural jobs. The government has a reform agenda, doing what it can to simplify consumer taxation, liberalise some markets, put in better infrastructure and change labour laws. The Prime Minister has put in a new sales tax, four new labour codes and various pro-business measures.

Chancellor Olaf Scholz’s recent visit saw Germany seeking improved trading arrangements with the emerging Asian giant. This was a reminder of how India is now being courted by the powers of the globe. They can all see that an Indian economy growing at 6% to 7% annually will become an ever-larger part of the economic and trading world, with an exciting market for their products. The US Congress is considering how they can help boost Indian development. Russia has been strengthening its trade links with the country too.

Benedict Tottman

Strategist at Charles Stanley

2. Going on a bear hunt

In the children’s book “We’re going on a bear hunt” a family head out for a walk to find a bear. They’re not scared. It’s an adventure. Until they come face to face with one in a cave. I have been reflecting a lot on bears lately, and bear markets in particular.

The equity bear market of 2022 fulfilled its typical function in exposing areas of excess (SPACs, crypto, loss-making tech, meme stocks), but we have not seen dramatic capitulation among equity investors. If 2022 was indeed a bear market, it was shorter and less extreme than many of its predecessors.

It is wise to treat bears with respect, but you can be too cautious. Interest rate rises are slowing; inflation seems to be peaking globally; energy costs have fallen; Chinese factories are coming back to life as Covid lockdowns lift; and global purchasing manager indices are back above the 50 level – the threshold between recession and expansion.

Will the bear re-emerge from the cave? Perhaps but another threat looks more serious now – inflation. Its power to erode the value of your wealth is so great that few of us can afford to avoid investment risk

Will the bear re-emerge from the cave? Perhaps but another threat looks more serious now – inflation. Its power to erode the value of your wealth is so great that few of us can afford to avoid investment risk.

We are underweight equities but not as underweight as we have been in the past. And we just added to bonds, which are looking much more appealing since the correction, enabling us to generate attractive returns with arguably lower risk. We are not scared but we are still treading with care.

Rosie Bullard

Portfolio Manager at James Hambro & Partners

Top Tip

I am very glad that this month’s commentary highlights how inflation can create a real need to take on more investment risk, albeit in a cautious way. People often think of themselves as risk-averse but don’t fully grasp that holding excessive cash in an inflationary environment is a serious risk to their wealth in itself. Your wealth’s growth must keep pace with inflation at the least.

You can of course aim for much better than that with a wealth manager, however – even if you wish to be quite conservative. In fact, very careful equities selection is looking like the order of the day generally; as one of our experts notes, many firms could soon be in for a larger-than-expected hit to corporate earnings.

Whatever your situation and risk appetite, a professional wealth manager can create a portfolio to suit your needs and the prevailing investment environment. Why not let us arrange some no-obligation discussions with the leading advisors on our panel so that you can fight inflation more proactively, yet still keep a tight rein on risk?

Lee Goggin

Co-Founder

3. Beware running bulls

In Ernest Hemingway’s The Sun Also Rises, a group of young expats travel to Pamplona for the running of the bulls. One expat, Mike, is asked how he went bankrupt. His reply: “Gradually, then suddenly.”

As the sun now sets on 2023’s first earnings season, we worry that equity markets are heading for a sudden shock.

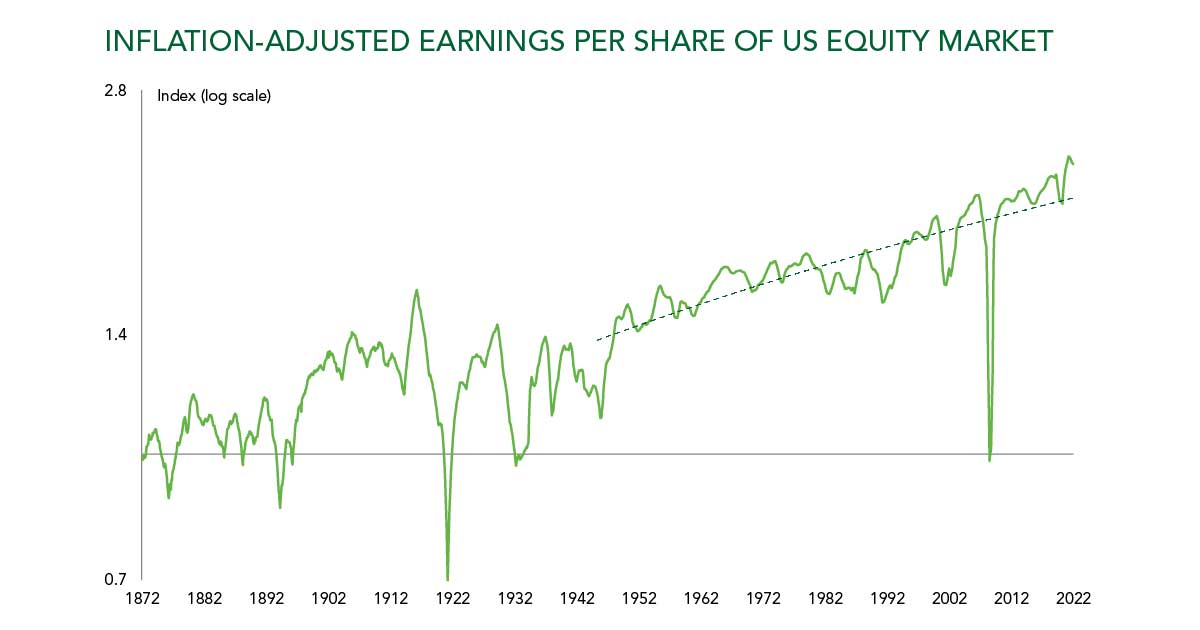

US companies have been hugely profitable since the pandemic. As the chart shows, real (inflation-adjusted) earnings per share for the S&P 500 are extremely high – 61% above the post 1945 trend line. Thanks to the disruption caused by the pandemic and a decade plus of zero interest rates, companies have enjoyed strong pricing power and low borrowing costs.

Sources: S&P, Shiller, Ruffer calculations. Numbers are the percentage gap between actual and trend EPS.

Now, these two tailwinds for earnings are reversing, a trend which could be exacerbated by a number of factors, such as higher energy costs and the shift to more local supply chains.

Crucially, investors are not being compensated for taking on this uncertainty about earnings. For example, a six-month US T-bill offers roughly the same yield as the earnings yield on US equities. Why take the extra risk of equities?

Yes, analysts have been gradually reducing their estimates for corporate earnings. But we think they are underestimating what could be a nasty earnings surprise.

Crucially, investors are not being compensated for taking on this uncertainty about earnings. For example, a six-month US T-bill offers roughly the same yield as the earnings yield on US equities. Why take the extra risk of equities?

While equity markets could hold up well in the coming months, we expect the second half of the year to be more challenging. So, we remain defensively positioned in the expectation that this year’s running of the bulls will end suddenly – with a goring for the unwary.

Rachel Holdsworth

Investment Manager at Ruffer LLP

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. This article does not take account of any potential investor’s investment objectives, particular needs or financial situation. This article reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. This financial promotion is issued by Ruffer LLP which is authorised and regulated by the Financial Conduct Authority. ©2023 Ruffer LLP. 80 Victoria Street, London SW1E 5JL. +44 (0)20 7963 8100. More information: ruffer.co.uk/disclaimer

Important information

The investment strategy and financial planning explanations of this piece are for informational purposes only, may represent only one view, and are not intended in any way as financial or investment advice. Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment and financial planning decisions.

Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.