This month:

Expert investment views:

Two scenarios are posited for what is likely to be a challenging year, albeit one with pockets of positivity

Investors are invited to consider ‘factor investing’ as a means to seek out the strongest equity market returns

Investors are warned of the risk of a Fed pushback against overly optimistic market expectations

Featuring this month’s experts:

1. Are pockets of positivity emerging?

Inflation remains uncomfortably high and interest rates look poised to continue to rise in the short term. However, improving inflationary trends in the major economies have led to some dramatic positive reactions in the markets: the pound has rallied, government bond yields have fallen, and equity markets have bounced backInflation remains uncomfortably high and interest rates look poised to continue to rise in the short term. However, improving inflationary trends in the major economies have led to some dramatic positive reactions in the markets: the pound has rallied, government bond yields have fallen, and equity markets have bounced back. We are still in the very early days of what will likely be a challenging year, but the outcome is likely to be somewhere between two extreme scenarios: prolonged period of higher inflation and interest rates leading to a worse than expected recession, damaging corporate earnings and therefore equity prices, but bond investors would benefit. The other being a continuation of the recent improving inflationary trends, meaning further interest rate rises are fully priced in and both equity and bond investors might benefit. 2023 should prove to be anything but dull.

Colin MacKenzie

Director, Investment Management at Arbuthnot Latham & Co., Limited

2. Seeking the ‘X factor’ in 2023

Insights from:

Trying to predict how 2023’s events will pan out is a daunting task for obvious reasons, but one thing is clear: investors are going to have to be far less forgiving and ensure that they are not holding weak names in their portfolios in order to weather any storms ahead well.

That modest (yet still not easy) ambition achieved, the braver among us do actually have a lot of opportunities to make attractive returns this year – if we alight on the right approach.

To our mind, this might look a lot like a strategy known as ‘factor investing’, as pioneered by Eugene Fama and Kenneth French in 1992 and for which they were awarded a Nobel Prize.

To our mind, this might look a lot like a strategy known as ‘factor investing’, as pioneered by Eugene Fama and Kenneth French in 1992 and for which they were awarded a Nobel Prize

In brief, factor investing involves targeting specific factors that have been shown to be associated with higher market returns, these being market beta, size and value.

Market beta refers to the sensitivity of a stocks returns to movements in the overall market. Stocks with the high beta are more volatile and tend to have higher returns in rising markets, while those with a low beta are less volatile and may have more stable returns.

The size factor refers to the size of a company, with small-cap stocks generally having higher returns than large-cap stocks.

Finally, the value factor refers to the valuation of a company, with value stocks (those that are trading at a discount to their intrinsic value) generally having higher returns than growth stocks.

From our experience, imposing this kind of investment discipline is very much associated with higher long-term returns than the broad market – and it is just the thing we should be thinking about amid January’s clean slate. Let’s clear out the clutter and focus on companies with that ‘X factor’ this year.

Alan Smith

CEO, Capital Asset Management

Top Tip

I’m very glad that this month’s wealth management commentators do indeed have positive messages for us to mull at the start of this new year. From our conversations with High Net Worth Individuals, it seems there are many investors – and particularly would-be investors – who are in need of some encouragement. Every day we speak to someone who has a lot of liquid wealth, but is nervous about putting it to work in these highly unusual times.

As our experts say, there are certainly pockets of opportunity out there for 2023 and investors should not stay on the side-lines out of fear – particularly if they have a real expert in their corner. Why not let us arrange some no-obligation discussions with the leading advisors on our panel to get an understanding of what your portfolio might achieve for you this year?

Lee Goggin

Co-Founder

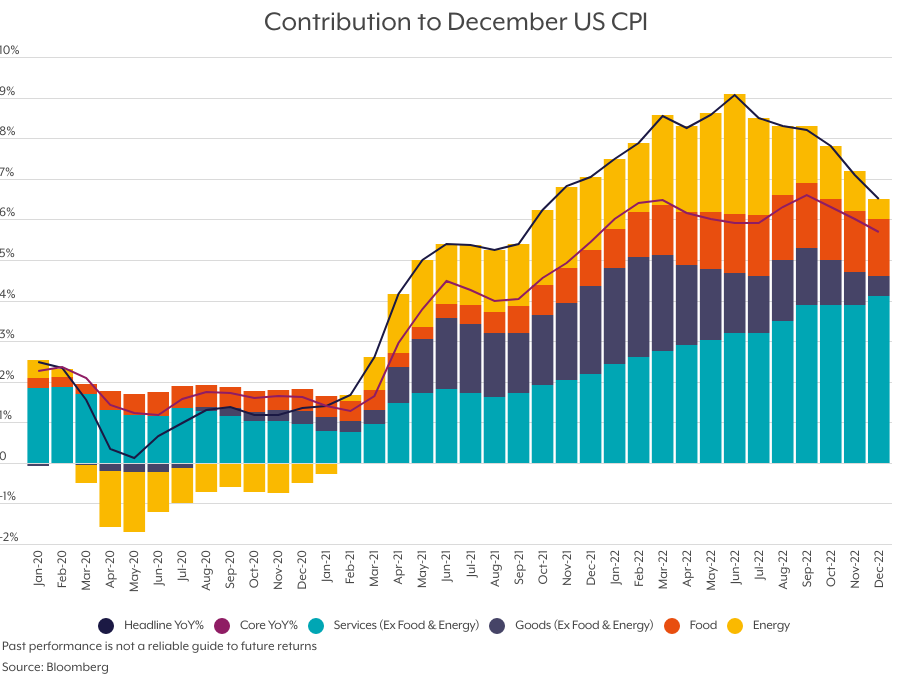

3. US CPI Downtrend Continues

US inflation data released on last week showed another slowdown in both the headline and core inflation rate over December. The headline year-over-year rate slowed to 6.5% from 7.1% the month before, in line with consensus expectations. The core year-over-year rate was also in line with consensus, at 5.7%, down from 6.0%.

One of the key drivers of the decrease in the headline rate was a fall in gasoline prices, which were 1.5% below their 2021 level at the end of last year. If oil prices remain at their current level, then the year-over-year change in gasoline prices will continue to become more negative over the coming months. Indeed, if other energy prices comply, the contribution of energy prices to overall CPI could soon turn negative.

Having been climbing over recent readings, the rate of increase in food prices is slowing, although price pressures remain acute for some food products. Within the core reading, rent continues see upward pressure, gaining 8.3% annually. We now see that real-time rents are falling, but it takes time for these changes to feed through to the CPI index, so pressure is not expected to ease in this component over the coming months.

While the overall direction of inflation is now clearly on a downward path, some details within the reading will cause some concern for the Fed

However, falls in other parts of the core basket, such as used and new vehicles, were enough to constrain the overall number. Given that all readings were in line with consensus expectations, the market will now look to Fed speak over the coming weeks to get a steer on the upcoming FOMC meeting in February.

Equity markets struggled to find a direction in the aftermath of the data release, however, market participants repriced the probability of a 50-basis-point hike from 25% to below 10%. While the overall direction of inflation is now clearly on a downward path, some details within the reading will cause some concern for the Fed. The contribution of services inflation continues to climb and is unlikely to ease until we see a genuine softening in hard employment data. The Fed will also not like the continued easing of financial conditions that market participants are generating, given that this fights against the tightening it has put in place. The risk of a push back from overly optimistic market expectations remains.

Benedict Tottman

Strategist at Charles Stanley

Important information

The investment strategy and financial planning explanations of this piece are for informational purposes only, may represent only one view, and are not intended in any way as financial or investment advice. Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment and financial planning decisions.

Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.