It’s now firmly back to school season, so to get in the spirit Fiona Oliver, Business Director at Partners Wealth Management offers readers the ‘Lesson 101’ on VCT and EIS investing. These are tax-efficient investments which all wealth management clients, or potential ones should know about.

As part of our Five Steps to Financial Freedom, we regularly speak to individuals about tax-efficient investing. It is important to note, allocating capital to Enterprise Investment Schemes (EIS) and Venture Capital Trusts (VCT) should only be considered when investors have maximised their pension & ISA contributions and are aware of the illiquidity risks.

What are VCTs?

VCTs are specialist investment companies listed on the London Stock Exchange (LSE). Newly issued VCT shares come with generous tax incentives from the Government and are designed to encourage investment in smaller UK companies.

VCT funds aim to help small businesses grow, create employment and benefit the UK economy. They tend to invest in younger companies, usually implying more risk than older, larger companies, and are selected for their rising-star potential.

Like investment trusts, VCTs are managed by professionals who aim to mitigate the risks inherent in small companies through diversification. Typically, they invest in 30 to 90 companies to reduce exposure to setbacks or failure at any one company, thus avoiding having too many eggs in one basket.

VCT funds aim to help small businesses grow, create employment and benefit the UK economy. They tend to invest in younger companies, usually implying more risk than older, larger companies, and are selected for their rising-star potential

With VCTs, the investor acquires shares in a trust (not in the individual companies) allowing exposure to the whole portfolio. This may also include larger and more mature businesses, into which the VCT invested in previous years.

As VCTs are listed companies, their shares can be bought and sold on the London Stock Exchange. In practice, trading in VCT shares is not particularly active, as secondary market transactions don’t give investors income tax relief and therefore shares tend to be valued at a discount to their Net Asset Value and may be difficult to sell. As a result, most VCT fund managers offer a buy-back policy.

Examples of VCT backed companies include: Zoopla, Cazoo, Tails.com and My 1st Years.

What are EISs?

EIS investments focus on the same type of companies as VCTs but invest directly in the companies resulting in less diversification. This means EIS investing is riskier than VCT; to reflect this, the tax reliefs are more generous.

One way to mitigate this risk is to access EIS opportunities through a managed portfolio. The investor would typically have access to 6 to 10 companies and be a direct shareholder of those EIS-qualifying companies. It is possible to invest in direct EIS offers, but investors will not benefit from diversification or the insight and access to the market from experienced fund managers.

EIS investments focus on the same type of companies as VCTs but invest directly in the companies resulting in less diversification. This means EIS investing is riskier than VCT; to reflect this, the tax reliefs are more generous

Generally, EIS-qualifying companies must have gross assets under £15 million and fewer than 250 employees. Up to £2 million may be invested in an EIS, subject to £1 million being invested in knowledge-intensive companies (companies carrying out research, development or innovation), which also enjoy preferential terms.

Examples of EIS-backed companies include: Bloom & Wild, Pasta Evangelists, Cera and Yasa.

Seed Enterprise Investment Schemes (SEIS) are focussed on start-ups and very early-stage companies. This type of investment carries more risk as investments are made into companies at the start of their journey. It is eligible to a tax relief of 50% on investments up to £200,000.

What tax reliefs are available?

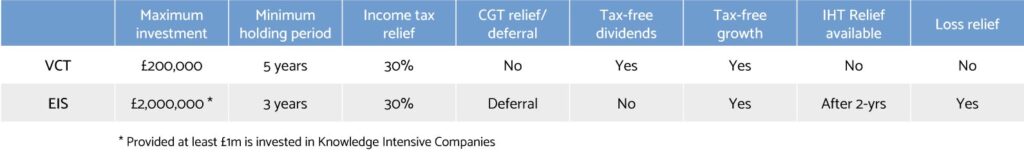

With both VCT’s and EIS, investors could get up to 30% income tax relief and tax-free growth. Moreover, VCTs offer tax-free dividends whilst EIS offer potential inheritance tax and capital gains tax reliefs. Tax benefits depend on personal circumstances and rules can change. The allowances are also very generous: up to £200,000 a year in VCTs and up to £2 million in EIS.

With both VCT’s and EIS, investors could get up to 30% income tax relief and tax-free growth. Moreover, VCTs offer tax-free dividends whilst EIS offer potential inheritance tax and capital gains tax reliefs

The table below provides an overview of how the available tax reliefs compare, but investors should make sure they are familiar with the considerable risks and rules before making any decision. Individuals should make investment decisions based on the merits of the fund offering, not for the tax advantages alone. Individuals should seek professional advice if anything is unclear after reading the offering documentation.

Top Tip

Surprisingly often Enterprise Investment Schemes (EISs) or Venture Capital Trusts (VCTs) are what brings affluent individuals to seek professional wealth management advice. While many people can sustain the concentration (and nerve) to run a portfolio over a long period, most will feel professional advice is in order when they are thinking of executing tax-advantaged investments where the rules are complex.

There are many strategies and instruments which could bring value to your wealth management plan, but many are easily got wrong. Let us arrange some no-obligation conversations with your best-matched wealth managers to make sure you are on the right track – the correct set-up is everything.

Lee Goggin

Co-Founder

PWM’s approach to tax-efficient investing

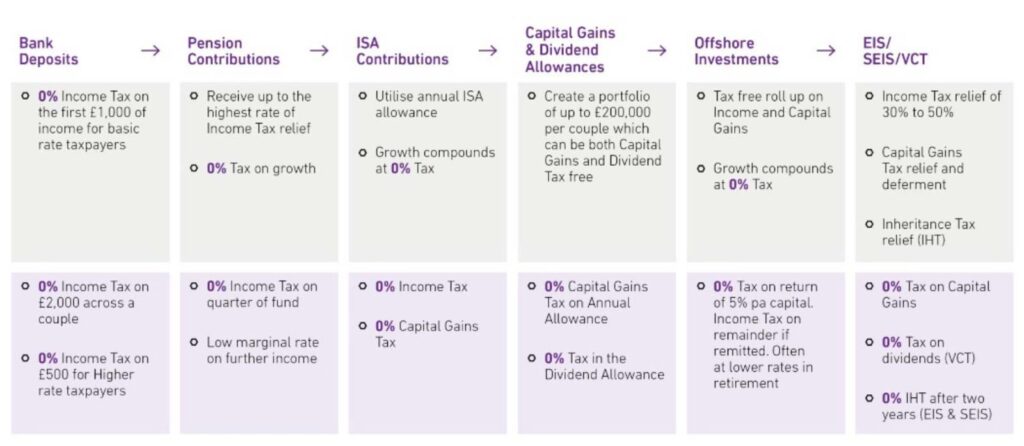

Although paying tax is inevitable, there are several legitimate ways in which an individual’s tax bill can be reduced. Our aim is always to structure assets to mitigate the tax burden while maximising the overall return. A good tax planning strategy will generally encompass the use of a variety of different financial products, savings options, investment strategies and retirement plans.

We help individuals plan their wealth over the course of their lifetime, ensuring maximum use of the tax-free allowances and tax breaks available. This means that in addition to ensuring that pensions are fully funded, we use the allowances available through ISAs, capital gains, dividends and interest, and investment in non-contentious offshore bonds. If individuals have a greater appetite for risk, we will consider statutory reliefs available with Venture Capital Trusts and Enterprise Investment Schemes.

Risk management & portfolio construction

As we classify EIS and VCT funds as high-risk products, we tend to recommend that individuals only have a maximum exposure of 25% of their investable wealth to these types of investments, provided they have the right risk appetite and long-term investment objectives.

We tend to recommend that individuals only have a maximum exposure of 25% of their investable wealth to these types of investments, provided they have the right risk appetite and long-term investment objectives

We also advise individuals to build a diversified portfolio of VCTs first. This is prudent from a risk management perspective, but also makes it administratively easier compared with EIS investing, as investors will receive one share certificate and one income tax certificate shortly after the shares have been allotted in the VCT. By comparison, with EIS investing, investors can receive multiple income tax certificates, as their capital is deployed into different companies, over a 12 to 18-month period.

Seeking financial advice

It is important to note investing in small companies can be risky, so it is essential to carefully consider the investment proposition fully before investing in these high-risk products.

It is important to note investing in small companies can be risky, so it is essential to carefully consider the investment proposition fully before investing in these high-risk products

If you are interested in learning more about this investment area and the benefits and disadvantages of each type of investment, we recommend that you seek financial advice. Our investment independence allows us to help support you in using EIS and VCTs as part of your overall investment strategy.

Important information

The investment strategy and financial planning explanations of this piece are for informational purposes only, may represent only one view, and are not intended in any way as financial or investment advice. Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment and financial planning decisions.

Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.