Introduction

Dennis Harhalakis, Founder of Cambridge Money Coaching, explains why reflecting on our feelings about money should be as much of a focus as market performance as the year ends.

As 2018 draws to a close, our inboxes are full of emails analysing the year’s market performance and offering predictions for the next 12 months. This annual ritual also comes with a side helping of reflection and good intentions for next year, once we get past the excesses of Christmas, of course.

As well as being bound to a rather arbitrary cycle, we also tend to focus in on investment performance before examining whether we are doing enough with the more foundational drivers of our financial destinies – how we feel and habitually behave.

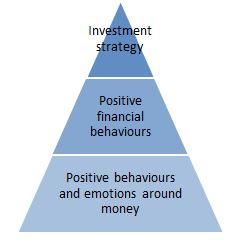

Before we can invest, we need to build wealth and understanding how this happens is both vitally important and often overlooked. Wealth-building can be visualised as a pyramid where investment strategy is the peak, but this can only be based on strong foundations – firstly, of positive feelings towards money and, secondly, healthy ways of deploying it.

Examine your emotions

We need to start by understanding our emotions around money: How does it make us feel? What do we use it for? What role does it play in our lives? Having a healthy relationship with money is like having a healthy relationship with food. We need food to survive, but an unhealthy relationship with food leads to sub-optimal behaviour around food and unhealthy outcomes at both ends of the scales!

Wealth can be created through hard work, but if an individual has a challenging relationship with money then the wealth may not last. On the flipside, few would advise living an unnecessarily parsimonious life, but stories abound of multi-millionaires who have done just that. One of the most important roles a trusted adviser can play is in helping us understand ourselves better and so achieve the right balance in how we manage our wealth.

One of the most important roles a trusted adviser can play is in helping us understand ourselves better and so achieve the right balance in how we manage our wealth.

Understanding our emotional relationships with money is very difficult because, as a society, we don’t have a framework for these types of discussions, which is why taking a quiz can be a good way in. Most people also find the risk-profiling exercises used by wealth managers to be very illuminating indeed.

Focus on financial behaviours

- Frugality – behaviours related to spending in relationship to income. In simple terms, this means spending below one’s means, which then drives the ability to save and then invest money.

- Confidence – having the skills and ability to build and maintain wealth.

- Responsibility – taking ownership and responsibility for financial outcomes.

- Social indifference – the ability not to be influenced by the spending behaviours and material possessions of others, as well as trends in consumer goods and services.

These competencies can all be developed by those who are prepared to invest the time and, unlike market returns, are all within our control.

As a simple illustration of what positive financial behaviour means, saving 10% of your salary per annum over 30 years rather than 5% means you need an annualized return of 5% rather than 9.967% to generate the same final sum. From a likely market return perspective, one is clearly more achievable than the other, and with a lot less risk. The same logic applies when we compare 30 years of saving versus 20 years of saving [as this feature highlights, it is time in the market, rather than timing it which drives overall returns].

We all tend to focus on the bare metric of one year’s investment performance and how the markets have done over the one we see drawing to a close. But we should never forget the power we ourselves hold to boost our financial futures. Harnessing the power of compound growth by investing for the long term; keeping a keen eye on investment performance and fees; and minimising tax are just the beginning of the steps conscientious individuals can take to maximise their wealth.

So, before you ponder investment strategy, spend a little time pondering the following two questions: Do I have a healthy relationship with money? What more is there within my control that will help me to reach my wealth creation goals? As Warren Buffet, said: ‘The most important investment you can make is in yourself’, and there is a lot to be gained by reviewing your situation and wealth management plan at least annually.

As Warren Buffet, said: ‘The most important investment you can make is in yourself’, and there is a lot to be gained by reviewing your situation and wealth management plan at least annually.