Introduction

Justin Urquhart Stewart, Co-founder of Seven Investment Management, explains why time in the market – rather than timing it – is a far greater driver of long-term returns than many investors realise.

Throughout the annals of investment history, there has always seemed to be some level of encouragement to buy and sell the market in a bid to boost investment returns.

The first such expression I heard was “Sell in May, go away and don’t come back until St Leger’s Day”. My personal favourite, however given I’m not particularly interested in a social season bookended by two horse races, is “Buy on the sound of cannons, and sell on the sound of trumpets”.

Both these “golden rules” are essentially telling us to time the market. But I don’t believe that it’s a behaviour that encourages success. That’s because it’s nigh on impossible to be able to sell out at the highest point and buy at the lowest point every single time, and if you did so too often then trading charges could overtake your returns.

To be fair, the “Sell in May” probably did make sense at some point in the past. If everyone involved in the markets was away on holiday then you can sit out of the low trading volumes. The low number of trades would also mean that stock prices wouldn’t move a lot in either direction given investments can go down, as well as up, to the point where your original investment is impacted. In today’s day and age, however, the FTSE 100 is traded overseas and even when the whole of the UK is shut for a bank holiday.

![]()

It’s nigh on impossible to be able to sell out at the highest point and buy at the lowest point every single time, and if you did so too often then trading charges could overtake your returns.

Putting theory to the test

To highlight our belief about time in the market being the better strategy, we ran some analysis. So, we “set up” two nominal investors with FTSE 100 portfolios dating back to 1 January 1989. One of these fictional individuals remained invested entirely throughout the following 30.7 years, while our other imaginary investor sold down their holdings at the end of each April and reinvested in mid-September. The slightly strange period is due to us wanting to get this article published!

Both strategies produced fairly healthy returns. The investor who cashed in their investments each summer saw an annualised performance of 8.3%, while the individual who just left things alone enjoyed a larger annualised return of 9.0%. Not much of a difference. However, if you then take compounding into account, they would have benefitted from a 1,182% gain, over 213% more than the buy and sell strategy.

Meanwhile, the index yielded positive returns for 22 of the 30 summers – over 70% of the time. And although we have to remember that past performance is no guide to future returns, for me a strategy that leaves me out of the money for over two-thirds of the time is not a wise approach.

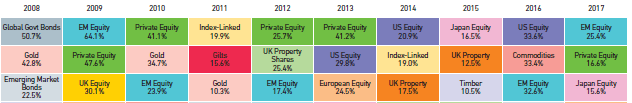

Even at an asset class level, we can highlight how the differences between year-on-year performance make predictions difficult. The chart below shows the top three and the bottom three asset classes in terms of annual performance over the last ten years.However, if you then take compounding into account, they would have benefitted from a 1,182% gain, over 213% more than the buy and sell strategy

In 2008, global government bonds were the best performing asset classes providing investors with a 50.7% return. In 2009, however, they were the worst performers. Other asset classes fluctuate as wildly too. After the 2008 performance, I’m not too sure that many private equity investors would be sufficiently invested to benefit the most from the 2009 recovery.

![]()

Even at an asset class level, we can highlight how the differences between year-on-year performance make predictions difficult.

So why do we hear of timing working?

I can think of three reasons: luck; a focus on one individual investment; or because you’re Warren Buffett. That’s because there are simply too many pieces of information that affect investments to really have a handle on all of the dynamics all of the time to be able to perfect timing trades.

To truly know when you should buy or sell stocks in the FTSE 100, for example, you would have to understand the market forces faced by all the competing companies for all of their products, as well as understand the domestic and political situation facing each industry and the country as a whole given the value of the FTSE 100 as a whole has recently been coupled with the Sterling exchange rate. Then you would have to overlay what’s happening to peers globally…

I think that you may get it right with one investment every now and then, but as soon as you start to diversify beyond that, out of all investors, Warren Buffett may have the best/ only chance of timing the market. After all, who else has the same army of analysts at their disposal?

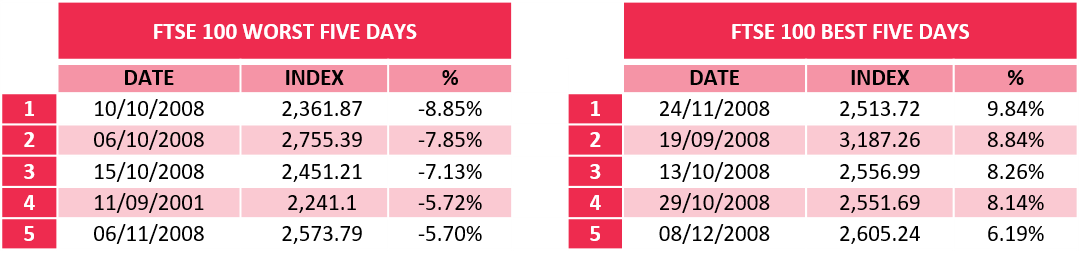

It becomes even more complicated when you appreciate that some of the stock markets’ best days often happen very soon after some of the very worse days. The table below shows the “top” five days in terms of the worst days of the FTSE (i.e. when performance dropped the most) and the best five, using the same period as our Sell in May analysis.

What this shows is that all bar one of these days across a 30.7-year time horizon are in a four-month period as the Global Finance Crisis hit. And while we would expect the worst days to be around this time, I’m not sure how many would expect all of the top five to be in this same period.

Line three in particular highlights how tricky life is for investors given the third best day in the FTSE 100 since January 1989 was 13 October, while its third worst day was just two days later. And I could include plenty of other examples to reinforce this same point.

This is why 7IM believes that it is time, not timing, that is the key to market returns. And, circling back to my favourite phrase about cannons and trumpets, while it is all very well and good in theory, most investors will find is difficult to remember when the bullets were actually flying! Instead staying invested for the long term can avoid costly mistakes both in peace time and in the heat of battle. And remember that time not timing may be a bit corny, but it gives it a firm finish.

Important information

The investment strategy explanations contained in this piece are for informational purposes only, represent the views of individual institutions, and are not intended in any way as financial or investment advice.

Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment decisions. Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.