David Goodfellow, Head of Wealth Planning at Canaccord Genuity Wealth Management, explains why cash flow modelling is vital in protecting your quality of life.

This question is the Holy Grail and is one a lot of people are asking themselves, as they wonder how to protect their wealth against this catastrophic economic fallout. Coronavirus has had enormous repercussions across our world – societies, economies, markets and day-to-day lives – and unfortunately it is likely to have an impact on our financial future too. This doesn’t necessarily mean your financial planning has been in vain, but it does mean it’s important to review your situation to ensure you have enough contingency in place.

Your financial plan needs to outline your financial objectives, tell you where you are with available income and assets and the position you will be in if you follow it

Your financial plan needs to outline your financial objectives, tell you where you are with available income and assets and the position you will be in if you follow it. Vitally, it needs to account for bumps in the road, such as the market volatility we are experiencing. And regular reviews – at least once a year or more if your situation changes – are essential.

A vital warning system

A review of your finances now can reassure you that your plans are still on track, or help you to make adjustments so you can still meet your long-term goals – you might not be able to commit to your plan, or need to check the assumptions in the plan are right, such as underlying investment returns.

Situations like the corona crisis mean it is important to factor in a conservative investment growth (between 2% and 4% depending on your risk-profile) as this allows for the good times, but also gives some leeway for changes in interest rates, inflation and financial crashes, without it affecting your long-term goals

Situations like the corona crisis mean it is important to factor in a conservative investment growth (between 2% and 4% depending on your risk-profile) as this allows for the good times, but also gives some leeway for changes in interest rates, inflation and financial crashes, without it affecting your long-term goals. To do this properly, you need to look at cash flow modelling.

Top Tip

Lee Goggin

Co-Founder

The situation:

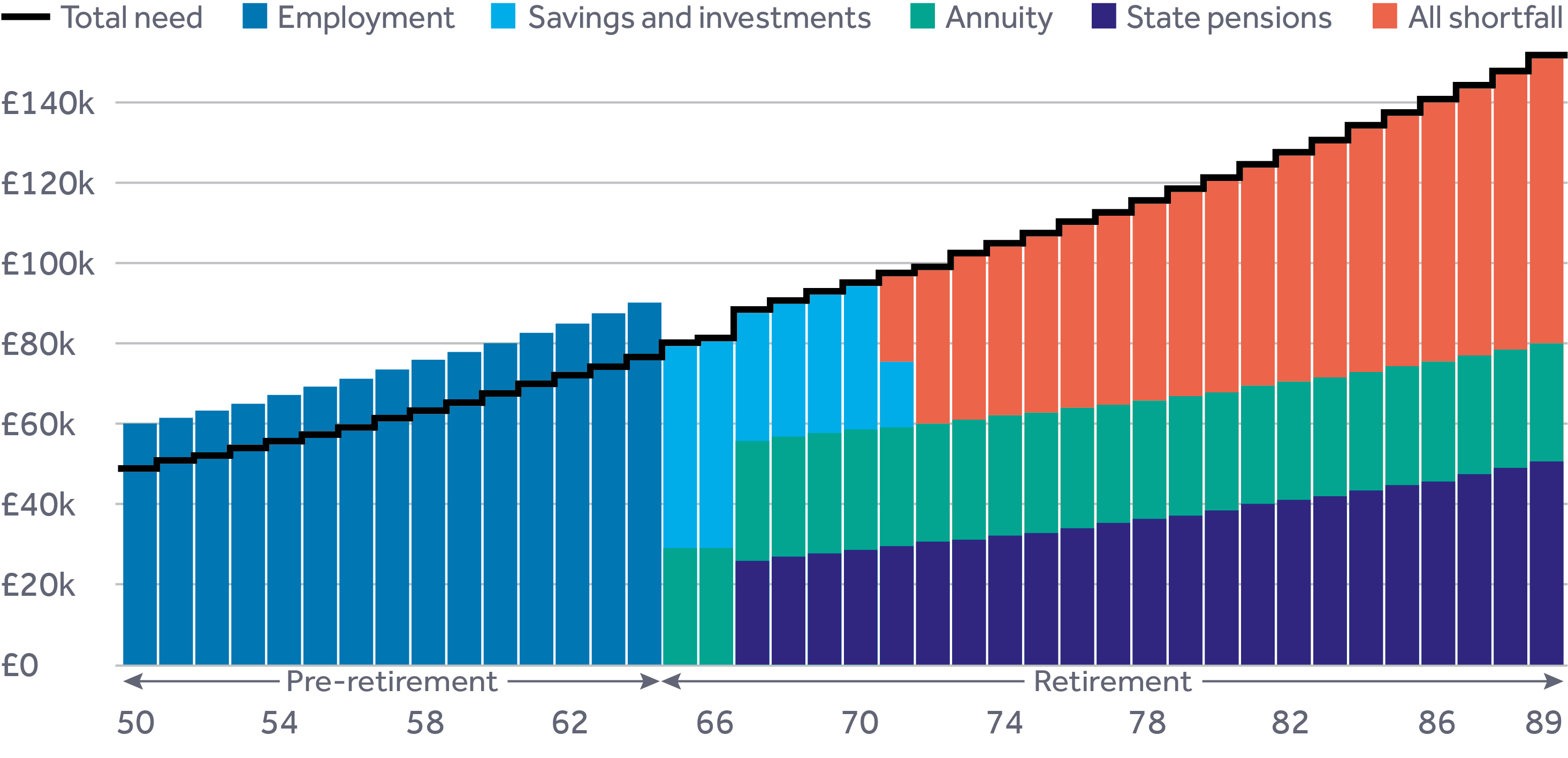

Sarah and Jack, both turning 50, came to us because they wanted to make sure their finances were on track and that they would be robust enough to survive an unexpected shock, such as a financial crisis or a change in personal circumstances. They were earning around £60k a year and predicted they would earn around £90k by the time they retired. Of course, they had no idea of their life expectancy or what challenges they might face, but we used cash flow modelling to help us figure out what ‘good’ might look like.

Of course, they had no idea of their life expectancy or what challenges they might face, but we used cash flow modelling to help us figure out what ‘good’ might look like

The solution:

Firstly, we built a complete picture of their finances by assessing their current and forecasted wealth, along with their income and expenditure. We checked their current arrangements – like their pensions and savings accounts – were right for their needs and we also highlighted any shortcomings that needed to be addressed.

We then tried out different scenarios to see if they would work for this couple. Although we hadn’t predicted the current crisis, we ensured their cash flow plan included alternative solutions for various eventualities. It illustrated different ‘what if?’ scenarios – such as ‘what if markets fall by 25%?’, ‘what if I don’t get paid for 12 months?’, ‘what if I can’t contribute fully to my pension?’, ‘what if I don’t get the big bonus I was expecting?’ or ‘what if my partner becomes ill?’

If you take a look at the first diagram, we found that, until they retire, Sarah and Jack will earn roughly 15% a year more than they spend (this is shown by the black line). Their savings, annuity and state pensions, which will kick in when they are 67, will be enough income for the first six years of retirement. But by the age of 71, their savings are reduced and they cannot spend as much as they would like. This considerable shortfall is shown by red bars in the graph.

The results:

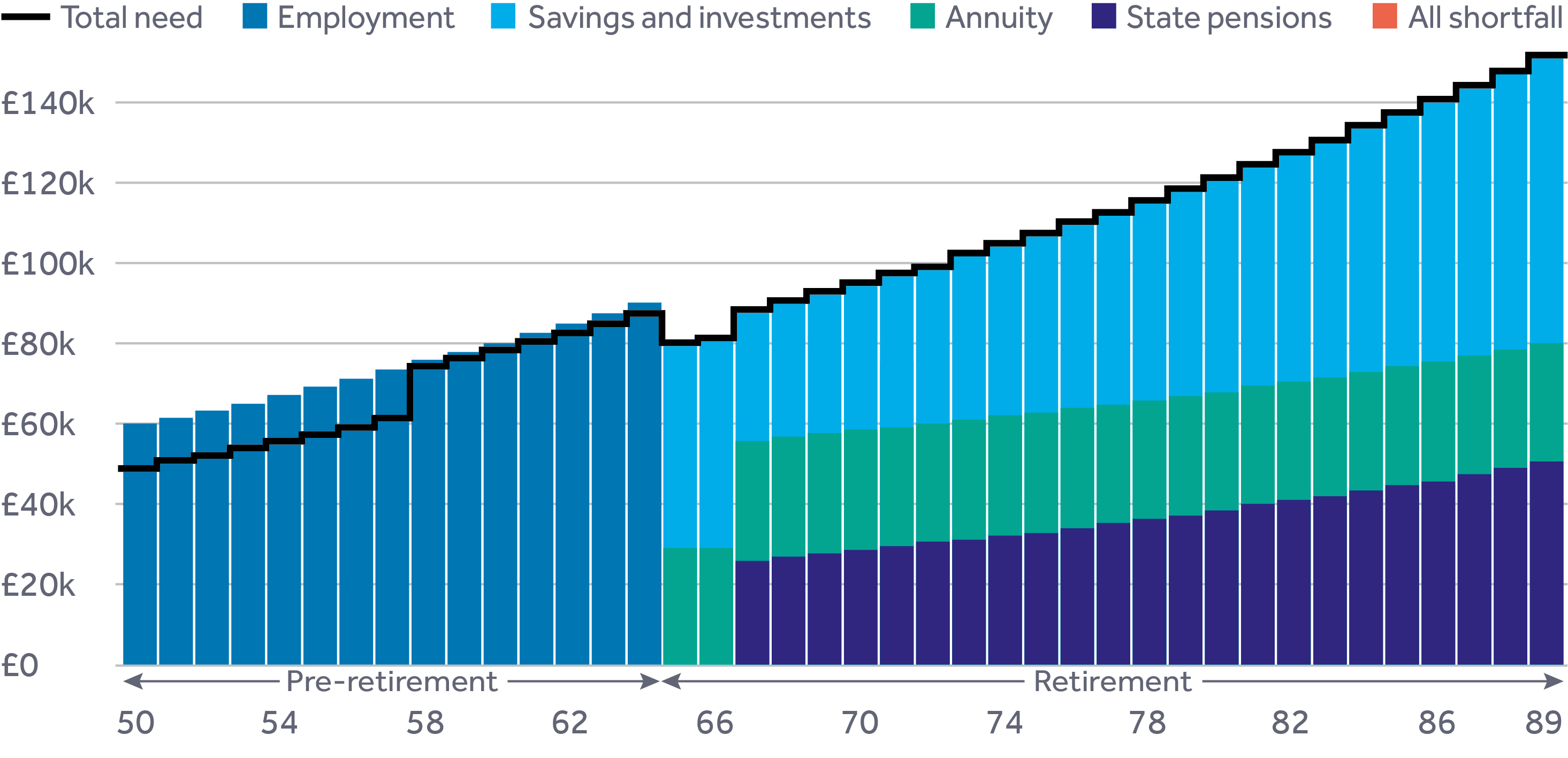

The cash flow modelling exercise helped us to come up with a new financial plan that would address some of the issues that had been highlighted.

For example, the surplus income that Sarah and Jack will earn in the years before they retire, is being used to make extra pension contributions and invest in ISAs. As the second chart shows, this will increase their pension contribution when they retire and make sure their investments last longer. The plan we came up with ensures there is no shortfall in their projected lifetimes. Regular reviews will be a must for Sarah and Jack, especially as they approach retirement – if there is another period of volatility as they approach this time, they might need to change the amount they were planning to draw, so they don’t deplete their savings.

Luckily, it’s unusual for the markets to drop by 25% as we have just witnessed, but we stress tested the plan to withstand a market fall. While the projected value of their savings and investments is lower, the plan is still on track to generate Jack and Sarah’s required income for life – giving them the reassurance they need at this unprecedented time.

The combination of cash flow modelling, a well thought through financial plan and an inbuilt “crisis planning” contingency isn’t necessarily failsafe, but it will stand you in much better stead than sailing on blindly

The combination of cash flow modelling, a well thought through financial plan and an inbuilt “crisis planning” contingency isn’t necessarily failsafe, but it will stand you in much better stead than sailing on blindly. You need to approach your financial future with a hefty dose of common sense and a side order of realism – it isn’t a sure-fire way to save your finances from the wolves, but it will give you a fighting chance.