Many people have been wedded to cash for decades and recent stock market volatility has hardly encouraged new investors to step up and take on risks they need to be convinced of. Careful planning and frank discussions can, however, help clients appreciate the investing opportunity, as Allie Kirk, Private Banker at Nedbank Private Wealth, explains.

The situation:

Mr and Mrs W were in their late 50s, and Mr W had retired from a career as a CFO for a large company. Having not had children, the couple believed that their substantial cash savings and property assets would be able to sustain their lifestyle throughout retirement.

The coronavirus pandemic, however, brought the realisation that the physical property assets they owned may not always be so easy to manage

The coronavirus pandemic, however, brought the realisation that the physical property assets they owned may not always be so easy to manage. Meanwhile, the actions of central banks – as they sought to support the rapidly rising levels of government debt – negated an income stream as interest rates were slashed to new record lows. In addition, the support that Mrs W wished to provide for her mother highlighted the potential for further outgoings that had not previously been considered.

As a result, they contacted the team at Nedbank Private Wealth to understand their options, and that sought a cautious approach to risk.

Top Tip

Many people favour property and cash, but as this case study highlights, they aren’t always the best store of value today – nor the most efficient means of attaining your financial goals. Exploring some higher-reward strategies, that are still low risk can be fast and free. Why not let us set up some calls for a convenient time?

Lee Goggin

Co-Founder

The solution:

The private banker to whom they were introduced provided some immediate advice on the opportunities available for them, and shared her experience of working with clients in similar situations. The couple then met an investment counsellor and a wealth planning specialist for conversations that plotted all of the “what if” scenarios that were of concern. For example, would they be able to shoulder the cost of the care of Mrs W’s mother without having to sell her home?

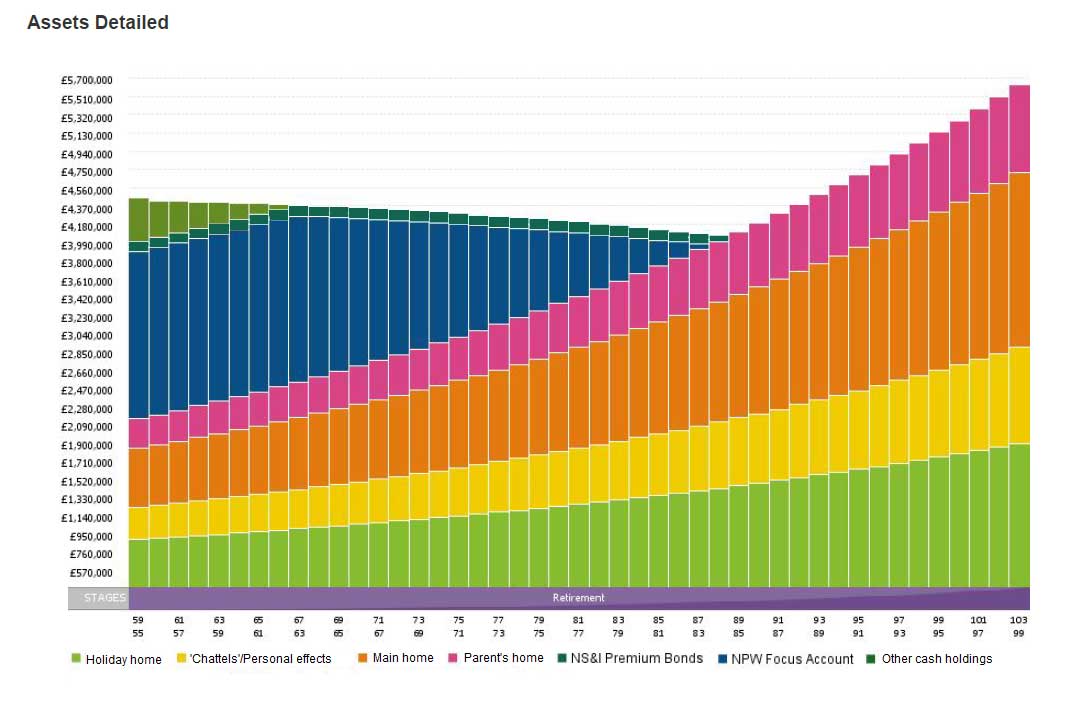

Working in tandem with the private banker, the wealth planner was able to draw up a cashflow plan that enabled them to see the projections for their cash savings over time. In addition, while inflation remains at very low levels, the private banker was able to help the clients understand that their personal inflation number was likely to be different from a centrally-published catch-all. The couple could also factor in planned short-term spending on home improvements.

While the couple had firmly believed their savings would last their entire lives, the cashflow projections instead showed their cash, based on the current spending, would only last until Mr W’s 89th birthday

While the couple had firmly believed their savings would last their entire lives, the cashflow projections instead showed their cash, based on the current spending, would only last until Mr W’s 89th birthday.

The couple completed a risk profiling questionnaire, which was then discussed with our investment specialist to explore investment options at the more cautious end of the risk spectrum.

The results:

The couple realised that their previous fall-back position of selling one of their properties was often not an option given the proceeds may be impacted if they were forced to sell at an inopportune time, while circumstances, such as a lockdown, could prevent a sale proceeding.

The couple realised that their previous fall-back position of selling one of their properties was often not an option given the proceeds may be impacted if they were forced to sell at an inopportune time, while circumstances, such as a lockdown, could prevent a sale proceeding

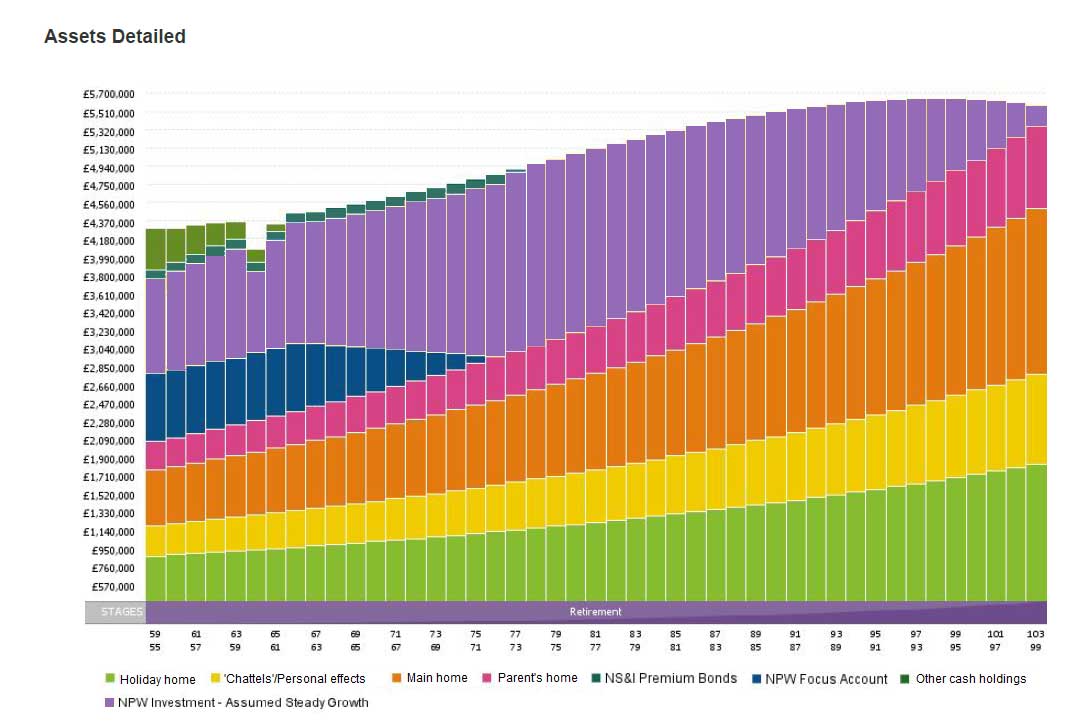

In addition, one of the cashflow “scenarios” included a 30% fall in financial markets across the board in the fifth year of investing to provide a practical view as to what that would mean for the couple’s finances. This highlighted the benefits of investing over the 30-40 years that the couple expected to live given their lifestyle and their family history of longevity.

The deciding factor, however, was the potential for new financial opportunities for them through investing when seeking to take a higher level of risk than initially discussed, which would enable the flexibility to sell assets at the “right” time, care for their elderly relative and have a wider range of choices for their own long-term healthcare, if needed.

In the clients’ own words, the recommendations were “an eye opener and exactly the guidance they needed” – advice which is now being implemented

In addition, the projections showed surplus income which would enable gifting to charity gifting and their wider family. In the clients’ own words, the recommendations were “an eye opener and exactly the guidance they needed” – advice which is now being implemented.

Does this case study resonate with you?

findaWEALTHMANAGER.com says:

Case studies can be an invaluable way to quickly see how a wealth manager has helped people similar to you. While details will of course remain anonymous, a prospective adviser should have abundant illustrations similar to this they can share.

If you have a specific pension planning question or feel the time is right for a thoroughgoing financial review, arrange to meet your best-matched advisers quickly and easily through our 3-minute search tool. Alternatively, please get in touch with our expert team to discuss your requirements further.