This month:

Equities and bonds are uppermost in our experts’ minds this month, but they also have plenty to say on other assets classes too. Read on for a truly global view of the world of wealth management for the months ahead

Expert investment views:

Investors are pointed to the likely changing fortunes of Western firms dependent on demand from China

Exceptional opportunities in fixed income are flagged, with corporate credit front of the queue

US and UK equities are examined in terms of how “the revered and the unloved” are changing

Featuring this month’s experts:

1. A Chinese bounce this Year of the Rabbit?

Equities made a strong start to 2023 with the main country-level benchmarks in positive territory (in sterling terms) for January. Europe and Asia-Pacific led the charge. Investor sentiment on Europe improved as energy supply concerns eased, while the faster-than-expected reopening of China meant that international investors have started allocating to the Asia-Pacific region again.

The Asia-Pacific regional equity index is in fact up 17% (in sterling terms) over the last three months and December’s announcement by the Chinese authorities of 10 Covid-easing steps, allowing their citizens to travel between provinces and enter many public venues without needing to show a negative test result, marked a turning of the tide for its residents which is likely to benefit investors significantly too. The start of January then saw quarantine requirements for travel dropped, making foreign travel easier. With multi-year Covid restrictions ending, investors have turned bullish on China: domestic equities traded in Hong Kong have performed strongly over the last three months, gaining 43% in sterling terms.

Chinese consumers are also expected to increase consumption following nearly three years of rolling lockdowns. This could provide a boost to Western firms dependent on demand from China, particularly those in luxury goods sectors

Chinese consumers are also expected to increase consumption following nearly three years of rolling lockdowns. This could provide a boost to Western firms dependent on demand from China, particularly those in luxury goods sectors. This year of the rabbit may well prove an auspicious one for those looking East.

Daniel Casali

Investment Strategist, Investment Management, at Evelyn Partners

2. The many facets of a balanced portfolio today

In trying to figure out whether the US or Europe will go into a recession, markets seem to be stuck in a “Goldilocks” scenario where they are assuming there will be a soft US landing with a Federal Reserve (Fed) that will cut rates this year, whilst corporate margins are preserved.

Equities have charged ahead with Fed officials in a blackout period. Bonds and gold have also surged. That combination does not look quite right. It may well be that the central banks this week (Fed, ECB, BoE) take the froth out by highlighting the right economic scenario.

Our view for the year is one of slowdown in the West and mild recovery in the East. The Chinese reopening has huge economic implications and should carry domestic consumption plus imports from Europe and other Asian countries. Our equity preferences are more tilted towards value than growth, emerging markets and the UK rather than the US or Japan, with a more defensive bias on our thematic ideas.

Our equity preferences are more tilted towards value than growth, emerging markets and the UK rather than the US or Japan, with a more defensive bias on our thematic ideas

In addition, we do not forget that fixed interest is now affording exceptional opportunities, notably corporate credit rather than government bonds, something that has not been seen in decades. Americans say the traditional, balanced 60-40 portfolio is back. It means you don’t need to take as much equity risk when bond coupons give you the same return.

Lastly, we have often mentioned gold as an important part of a balanced portfolio. That view has not changed. Despite soaring US tech, gold has returned as much as US equities have since the market bottomed in October.

Michel Perera

Chief Investment Officer at Canaccord Genuity Wealth Management

Top Tip

This month’s investment commentaries span equities across a number of Western and Eastern markets, both government and corporate bonds, gold and property, as well as all the monetary policy and economic factors underpinning their stories. They are a great illustration of why even the most enthusiastic DIY investors usually turn to the professionals in the end. Keeping on top of everything which drives strong returns is a huge task for just one person.

Delegating to a wealth management firm will give you access to great intellectual capital across all asset classes, but most important of all, it will give you back your time. Why not let us arrange some no-obligation discussions with the leading firms on our panel to see what the professionals have to offer?

Lee Goggin

Co-Founder

3. The revered and the unloved

2022 was an extraordinary year in many ways. For investors in US equities, it could be remembered as the year when the dominance of the large consumer technology and communication shares over market returns was finally broken.

Expensive valuations, tighter liquidity conditions in the form of higher borrowing costs, and a narrowing gap of expected profit margins over other sectors were all contributors to the weakest relative performance of high growth stocks in 15 years.

We already cautioned that corporate profits everywhere could be further tested in all but the most benign scenarios this year. In the latest earnings season, many of the largest tech firms missed consensus earnings estimates by 8% in aggregate, according to Bank of America – with earnings growth for the Nasdaq-100 now lagging the S&P 500 for the past five quarters.

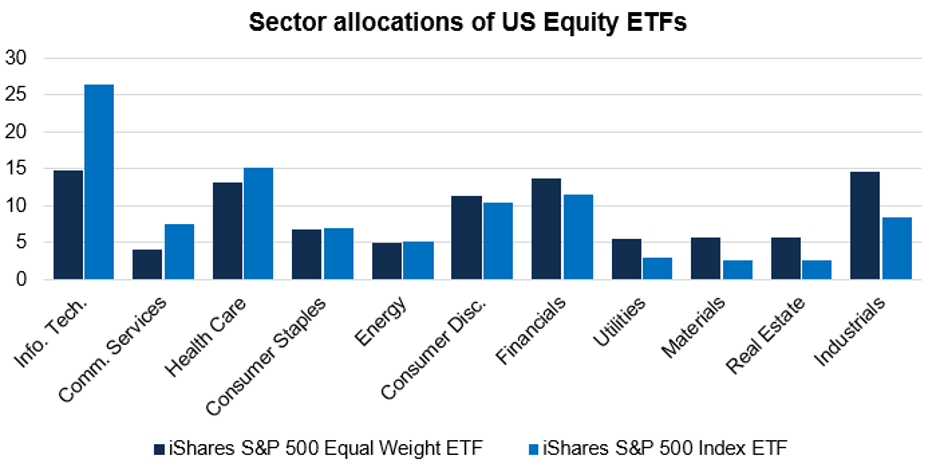

To counter the entrenched optimism on tech and communications, a more diversified allocation such as an equal-weighted US equity ETF could prove more resilient than a regular, size-weighted index as investors adjust their expectations

Yet to counter the entrenched optimism on tech and communications, a more diversified allocation such as an equal-weighted US equity ETF could prove more resilient than a regular, size-weighted index as investors adjust their expectations.

What, then, about the UK? The UK stock market outperformed global markets meaningfully in 2022, but this was driven by the sector mix of companies in the FTSE 100 rather than reflecting market confidence in the domestic outlook. Most of the UK remains cheap and unloved by international investors – but is that for a good reason?

The outlook is challenging to say the least, with many domestic-focused small and medium-sized companies facing higher interest rates and at least some costs elevated by a weaker pound, while selling to consumers who are themselves cutting back on spending. The commercial property sector has also been hit hard, with concerns over empty offices, struggling retail and what looks like a deflating bubble in warehouses and storage.

Although catalysts for better performance from smaller companies are hard to find against such a gloomy backdrop, a lot of the negativity is priced in: returns of the FTSE 250 Index have rarely been so weak compared to the FTSE 100. From such starting points future returns have usually been impressive.

Dividend streams will offer support to income investors, whereas the strength of some structural growth themes will begin to be valued more highly. We have rightly been very wary on property to date, but the potential for attractive rental yields that can be marked higher with any inflationary surprises could also be an interesting small addition to portfolios should the UK outlook begin to improve.

Simon McConnell

Senior Portfolio Manager at Netwealth Investments

Important information

The investment strategy and financial planning explanations of this piece are for informational purposes only, may represent only one view, and are not intended in any way as financial or investment advice. Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment and financial planning decisions.

Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.