This month:

Expert investment views:

The Omicron COVID-19 variant is tagged as an inflationary influence set to further fan the flames

The case is made for thinking laterally when it comes to protecting portfolios against inflation and climate change

Investors are warned that negative interest rates could hit equity valuations hard

Featuring this month’s experts:

1. From alpha to omega

It is disappointing that 2022 looks set to start with lower levels of optimism than 2021 did. Following the misery of 2020, many were hopeful that the new, highly-effective vaccines would bring a new dawn, ending the worst of COVID-19. However, despite the numbers of inoculated individuals, mostly in developed markets, we will probably continue to see restrictions of some ilk. This means the 2022 outlook might only be a poorly developed sequel to the 2021 narrative.

Except there is a new storyline in inflation. And it’s a tale that promises to provide plenty of twists and subplots.

One of these is Omicron, the latest COVID-19 variant, which in our view is inflationary. While a dramatic subplot has been avoided because the World Health Organization, rather wisely, skipped the Greek letter Xi when naming it, Omicron could still dominate the yarn given the apparent ease of its transmission, the remaining uncertainty surrounding the severity of its symptoms and the consequences these may have on consumer demand and supply chains.

Omicron could still dominate the yarn given the apparent ease of its transmission, the remaining uncertainty surrounding the severity of its symptoms and the consequences these may have on consumer demand and supply chains

Another twist comes from the request by the Federal Reserve (Fed) chair, Jay Powell, that the tag “transitory” be removed when discussing inflation. Powell hasn’t provided a direct replacement for the term. Instead, he has recommended that we “try to explain more clearly what we mean”, which is difficult given the plethora of different scenarios being put forward by central bankers, and not just those at the Fed.

Last but not least, the inflation story may also be influenced by new, as yet unknown and unnamed, mutations of the COVID-19 virus. After all, omicron is not at the end of the alphabet we’re using – omega is. As such, I can’t see any alphabets spelling ‘The End’ for the stories linked to the pandemic, its impact on the economy and financial markets, or inflation any time soon.

Rebecca Cretney

Investment Counsellor at Nedbank Private Wealth

2. We’ll continue to feel the heat – on two counts

2021 has seen the world move from lockdown to a progressive return to normal in many countries, supercharged by vaccinations. Who knows what 2022 holds in the COVID-19 stakes, particularly with the Omicron variant? But in investment terms, we can clearly see two long term trends emerging.

The first is inflation, which has soared since March 2021 and is worrying many in the markets. So, when we are investing, we look for themes that benefit from rising prices. Equities are generally more defensive against inflation than other asset classes. Automation and robotics is one theme – boosting productivity and helping businesses drive costs down is becoming key for economies which are facing dwindling or ageing populations. Infrastructure is another – a global way to improve our economic and social functioning. This is evident in global commitments to infrastructure investment, such as the US passing its US$1.75trn ‘Build Back Better’ bill in November

Electric vehicles (EVs) are another growth area, but it’s not just about the manufacturers – it’s thinking about the investment opportunities in batteries and charging networks

Our second big theme is climate transition and we think about it laterally. Clean energy will play a vital role in the coming years – coal is now responsible for almost one in five global deaths – so alternatives to fossil fuels are crucial. Electric vehicles (EVs) are another growth area, but it’s not just about the manufacturers – it’s thinking about the investment opportunities in batteries and charging networks. And sustainable food production is our last theme, imperative in the reduction of CO2 and the provision of nutritious food for our populations – again, it’s not just about milk alternatives or meat substitutes. It is about looking for innovations in sustainable food manufacturing and transportation.

So whatever 2022 will bring, we think inflation and climate transition are themes that will prevail throughout next year.

Michel Perera

Chief Investment Officer, Canaccord Genuity Wealth Management

Top Tip

The High Net Worth Individuals we speak to are almost universally worried about inflation and interest rates which could scupper their investment strategies by becoming either too high or too low. But as this month’s experts set out, there are opportunities amid the gloom to cheer us over the holidays. Why not have some no-obligation discussions with the wealth managers from our panel to hear about the opportunities they have identified?

Lee Goggin

Co-Founder

3. Negative real interest rates can be bad news for equity valuations

At Ruffer, our job is to protect our clients’ savings against whatever might go wrong in markets. Our focus on risk means that we see the mousetrap clearer than the cheese.

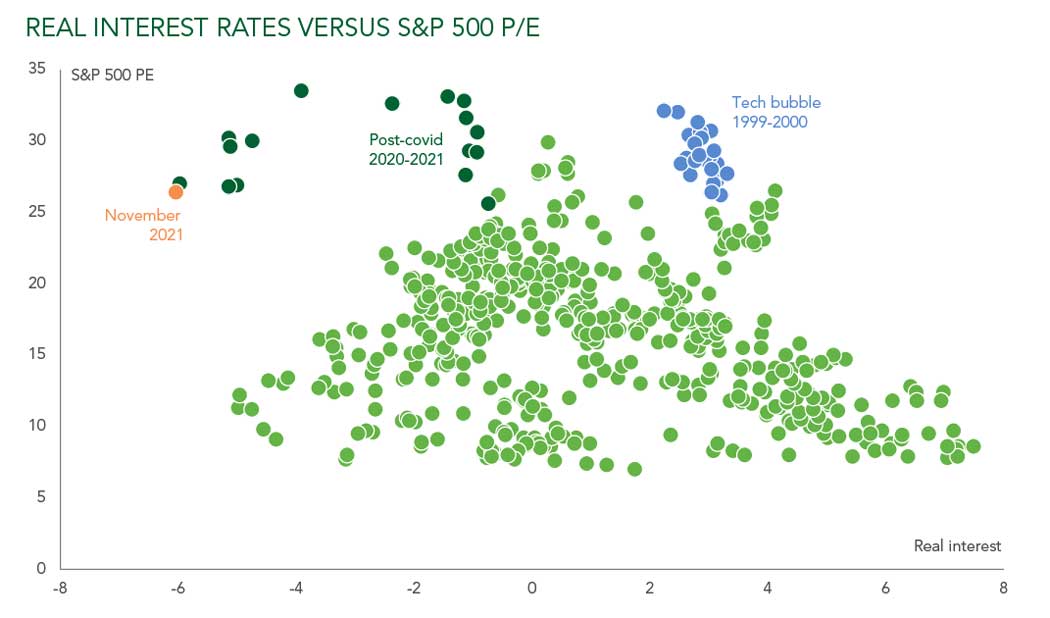

This month’s chart is aimed at countering the current idea that highly negative interest rates are supportive of sky-high equity valuations.

Historically whenever real interest rates have deviated from the ‘Goldilocks’ range of -2% to 2%, stock market price-to-earnings ratios (P/Es) have fallen. The only exceptions being the tech bubble in 1998-2000 and the recent post-covid period. The first – as you know – ended badly.

If interest rates jumped to 10%, then future profits from equities would have to be discounted at 10% a year. Bad news for all stocks, but especially growth stocks, where most of the profits and cashflows are expected to be paid in the distant future

This is all about the discount rate. The rate at which we need to discount future profits or cashflows to work out what they are worth today.

If interest rates jumped to 10%, then future profits from equities would have to be discounted at 10% a year. Bad news for all stocks, but especially growth stocks, where most of the profits and cashflows are expected to be paid in the distant future.

Similarly, if inflation is running at 10%, then future profits and cashflows need to be discounted at 10% to get their true value in real terms today. Again, terrible news for markets.

If inflation stays elevated, even if central banks keep interest rates low, then current stock market valuations will prove far too high.

Equities are considered ‘real assets’ whose cashflows may rise with inflation. This makes them better than conventional bonds when inflation is high. But watch out for a de-rating that could cost investors dear.

Source: Datastream, Ruffer LLP, data 1974-2021

Steve Russell

Investment Director at Ruffer LLP

Important information

The investment strategy and financial planning explanations of this piece are for informational purposes only, may represent only one view, and are not intended in any way as financial or investment advice. Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment and financial planning decisions.

Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.