This month:

Expert investment views:

Recent market movements are put into context, raising the possibility of further rallies

Investors are urged to heed growing regional differences as they reposition the equities portions of their portfolios

Three sectors in the FTSE100 are highlighted which could do well in light of prevailing energy and demographic trends

Featuring this month’s experts:

1. When bad news is good news

Fears around inflation in the first half of the year caused equity markets to swing sharply downwards. The S&P tumbled 20% and the Nasdaq nearly 30% – the worst first-half performance for US markets since 1970. Over in bond land yields were up an astonishing 90%. If equities are swings, bonds are see-saws. Rising bond yields mean falling prices, and this year has been painful for many bond holders too.

The Federal Reserve has led central banks in lifting interest rates. Its June hike of 0.75 basis points was big by historic standards and substantial relatively speaking. It then repeated the move in July, determined to tame inflation.

This has prompted a change of the narrative in markets – from anxiety about inflation to concern about recession. Markets are strange places. Sometimes bad news can be good news. In July the S&P 500 index rose 9% – its biggest monthly gains since November 2020. The Nasdaq shot up 12%.

The thinking is that if recession is here or imminent, the Fed and other central banks can take their foot off the gas in terms of tightening monetary policy

Why? The thinking is that if recession is here or imminent, the Fed and other central banks can take their foot off the gas in terms of tightening monetary policy. Whether they will, remains to be seen. Company results have been generally reassuring and many have surprised to the upside, particularly large cap tech.

Bear markets often see short-lived rallies. In the current economic and geopolitical environment there are so many possible outcomes it makes it hard to position your portfolio. We could see markets rise another 10% or fall just as far. They may have done so between me writing and you reading this! We remain underweight equities until we can be more confident about the direction of travel.

Rosie Bullard

Partner and Portfolio Manager at James Hambro & Partners

2. International markets and interest rates

At the time of writing (end-July) it seemed like inflation may have peaked, in the US at least. But the speed at which it comes down will determine whether central banks can actually stop hiking and even reverse rate increases. Nothing points to the former yet, let alone the latter. US inflation is stickier than in other western countries because it has had time to spread round the economy. That is not the case for the eurozone and the UK, where energy and food inflation still dominates.

Markets are therefore overoptimistic about the Fed’s willingness to relent on rates. There’s still tightening, which acts with a lag on the economy. A policy “pivot” could mean slower rate hikes in the autumn, but the bar for actual rate cuts is very high.

Until the Fed is ready to pivot, it makes little sense to have too much exposure to long duration sectors, like profitless tech

But investors are saying the Fed will peak at 3.3% this year before cutting rates. This is wishful thinking and means that the tech sector – which has rallied very hard this month – should be reduced in favour of more defensive sectors. Until the Fed is ready to pivot, it makes little sense to have too much exposure to long duration sectors, like profitless tech.

Conversely, Asian markets, the UK and even Europe, have rallied much less than the US market in the last month and may offer better opportunities, together with more defensive sectors, such as healthcare, infrastructure. The energy sector has had significant profit-taking but the supply-demand fundamentals and technical positioning still make the sector a potential market leader for the next few months.

Michel Perera

Chief Investment Officer at Canaccord Genuity Wealth Management

Top Tip

Lee Goggin

Co-Founder

3. Three sectors to watch in the FTSE100

In a choppy environment, one market we are particularly keen on is the FTSE 100. Here are a few reasons why we think it remains well placed to outperform. That might sound strange in the face of a cost-of-living crisis and a lack of political leadership, but bear with us.

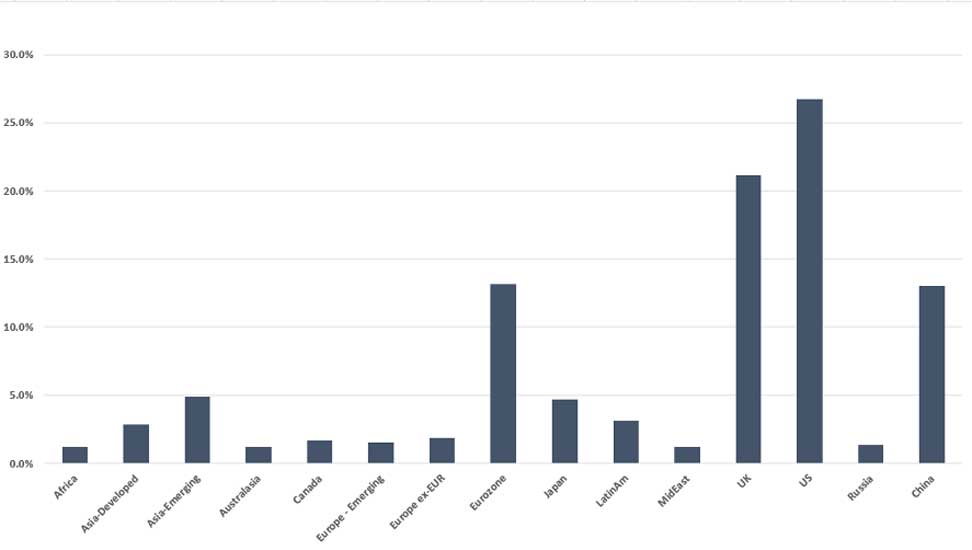

First, it’s crucial to realise that the FTSE has nothing to do with the UK economy (OK, maybe not nothing, but very little). The chart below shows the revenue exposure by region of the companies in the FTSE 100… the majority of sales come from outside of the UK. For many of the companies in the FTSE 100, UK economics is largely the “local news” at the end of the main bulletin.

FTSE 100 by Geographical Revenue Exposure

Source: Morningstar Direct

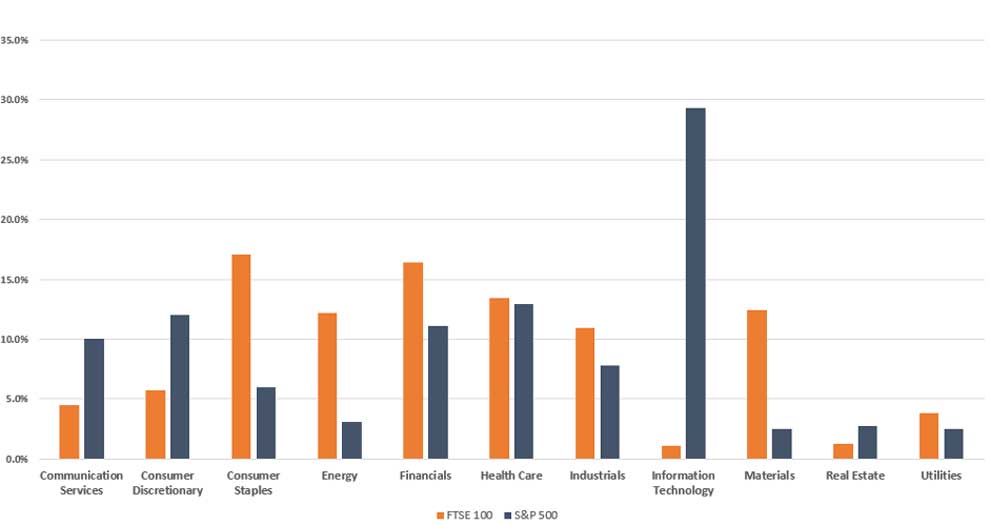

And the FTSE 100 has lots of exposure to sectors we like:

The first of which is energy. The FTSE is home to energy giants such as Shell and BP. With energy commodity prices where they are, these companies are extremely profitable and even after their outperformance, they are still relatively cheap.

Related are materials. The story for materials is similar to energy: they’re cheap, profitable companies. They also have the added kicker of being crucial to the clean energy transition. The infrastructure required to get the world meaningfully using renewables isn’t going to happen without vast amounts of copper, cobalt, and lithium.

The infrastructure required to get the world meaningfully using renewables isn’t going to happen without vast amounts of copper, cobalt, and lithium

Finally, healthcare, which we’ve been positive on for a long time. It has diversifying defensive properties. Not only that, but when combined with the developed world’s rising life expectancy and demand for healthcare, we think the sector is in a good place.

FTSE 100 vs S&P GICS Sector Exposure

Source: Bloomberg

Source: Bloomberg

Salim Jaffar

Investment Analyst at 7IM

Important information

The investment strategy and financial planning explanations of this piece are for informational purposes only, may represent only one view, and are not intended in any way as financial or investment advice. Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment and financial planning decisions.

Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.