Mark McNamara, Wealth Manager at LGT Vestra LLP, explains why his firm is highly attuned to the needs of family business owners and what some of the key issues they need to address are.

LGT Vestra LLP is part of the largest private banking and asset management group owned by a single entrepreneurial family. We believe we are uniquely positioned to understand the complexities and sensitivities involved in managing family wealth, governance and succession across generations. Over the last 900 years, the family office of the Princely House of Liechtenstein has successfully transferred its family traditions and entrepreneurial spirit from one generation to the next.

Why are family businesses unique?

The issues facing family businesses are often centred around a lack of recognition and understanding of the structural differences between how family and business institutions are governed.

A family is built on the principle of looking after one another, whilst a business is largely built on innovation, productivity and profitability. As a result, an entrepreneurial family requires recognition of not just the traditions, values and culture that has built a successful business, but an understanding of the interaction between the business, ownership of the business and the family.

A family is built on the principle of looking after one another, whilst a business is largely built on innovation, productivity and profitability

The issue is that every family is unique, which is why experience of the organisation and its people are key when dealing with entrepreneurial families who are seeking a relationship with a wealth manager. However, there is commonality in terms of the type of services they require and the questions the family should be asking of their wealth manager.

Family business planning

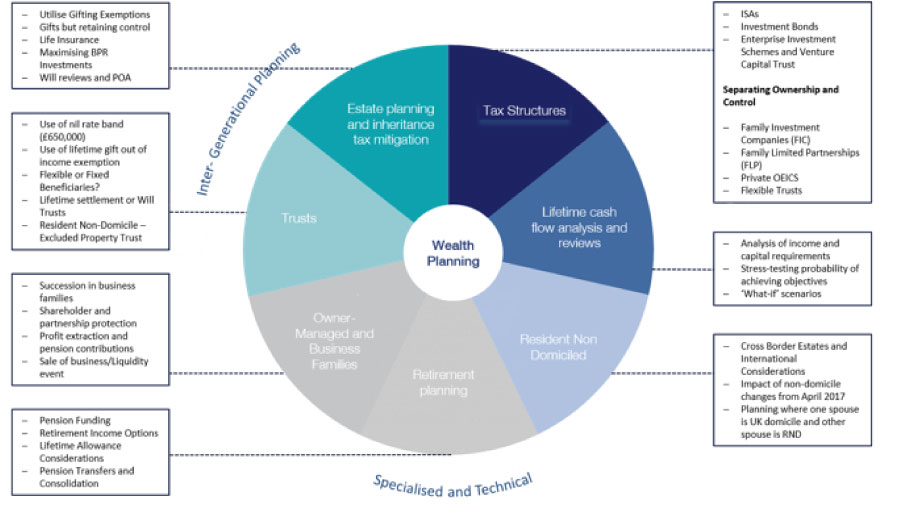

Our services specific to family business owners are part of an overall wealth planning discussion (see below chart) and include the following:

- Establishing effective governance blueprint

- Succession planning for the effective ownership of the family enterprise

- Education for both the existing and next generation

- Introduction to a network of specialist advisers as required

- Wealth and estate planning

- Philanthropic engagement

Our view is that a comprehensive wealth planning review is the most effective approach. We provide a fully tailored service to help entrepreneurial families navigate their business, ownership and family structures through the creation of a dynamic governance framework and succession strategy.

We undertake a thorough fact find with our clients encompassing both qualitative and quantitative aspects of their lives, to ensure that we have a clear understanding of their aspirations, business interests, assets and liabilities and family dynamics, to enable us to achieve their objectives within the time horizons specified.

Our view is that a comprehensive wealth planning review is the most effective approach. We provide a fully tailored service to help entrepreneurial families navigate their business, ownership and family structures through the creation of a dynamic governance framework and succession strategy

We provide wealth planning and structuring advice for a full spectrum of clients at all stages of life. High net worth clients with liquid wealth between £1m15m represent over 70% of our client base and we are well resourced and experienced in working with entrepreneurial families, given they represent the back-bone of our business.

Top Tip

Lee Goggin

Co-Founder

Top 10 questions to ask of your wealth manager

Ultimately, any relationship with the wealth manager is about trust and in building that trust, we think the below questions are the most important from the family’s perspective:

- Experience – have they done this before?

- Transparency – what are my total costs of engaging you as the wealth manager?

- Independence – are you looking to sell me a product or a solution?

- Ownership – is there alignment of interest between the wealth manager and my family?

- Fees – am we getting value for money?

- Safety – are my assets secure?

- Track record – investment performance net of all costs?

- Breadth – what additional services do they have such as wealth planning advice or lending?

- Culture – does the organisation fit in with our beliefs as a family?

- Education – are they willing to put in the time to educate our family in all things financial?

Passing on the knowledge and experience of a family who have been managing wealth for over 900 years is something we take seriously and is invaluable as we look to advise families in various aspects of their long-term financial planning

Passing on the knowledge and experience of a family who have been managing wealth for over 900 years is something we take seriously and is invaluable as we look to advise families in various aspects of their long-term financial planning. Professional wealth management advice can add immense value for every type of affluent individual advice, but perhaps never more so than for the family business owner given the myriad challenges – and opportunities – they encounter.