Charles Calkin, Financial Planner at James Hambro & Partners, sets out how powerfully freezes to tax allowances are eroding wealth – and offers steps individuals can take to combat this threat to their financial plans.

For many years our clients have been kept awake at night by the threat of a wealth tax. Now, there is a new danger for them to lose sleep over – stealth taxation. The Treasury has frozen most of the core allowances that help mitigate the pain of taxation. The bracing wind of inflation looks set to turn this fiscal cold snap into a long dark winter.

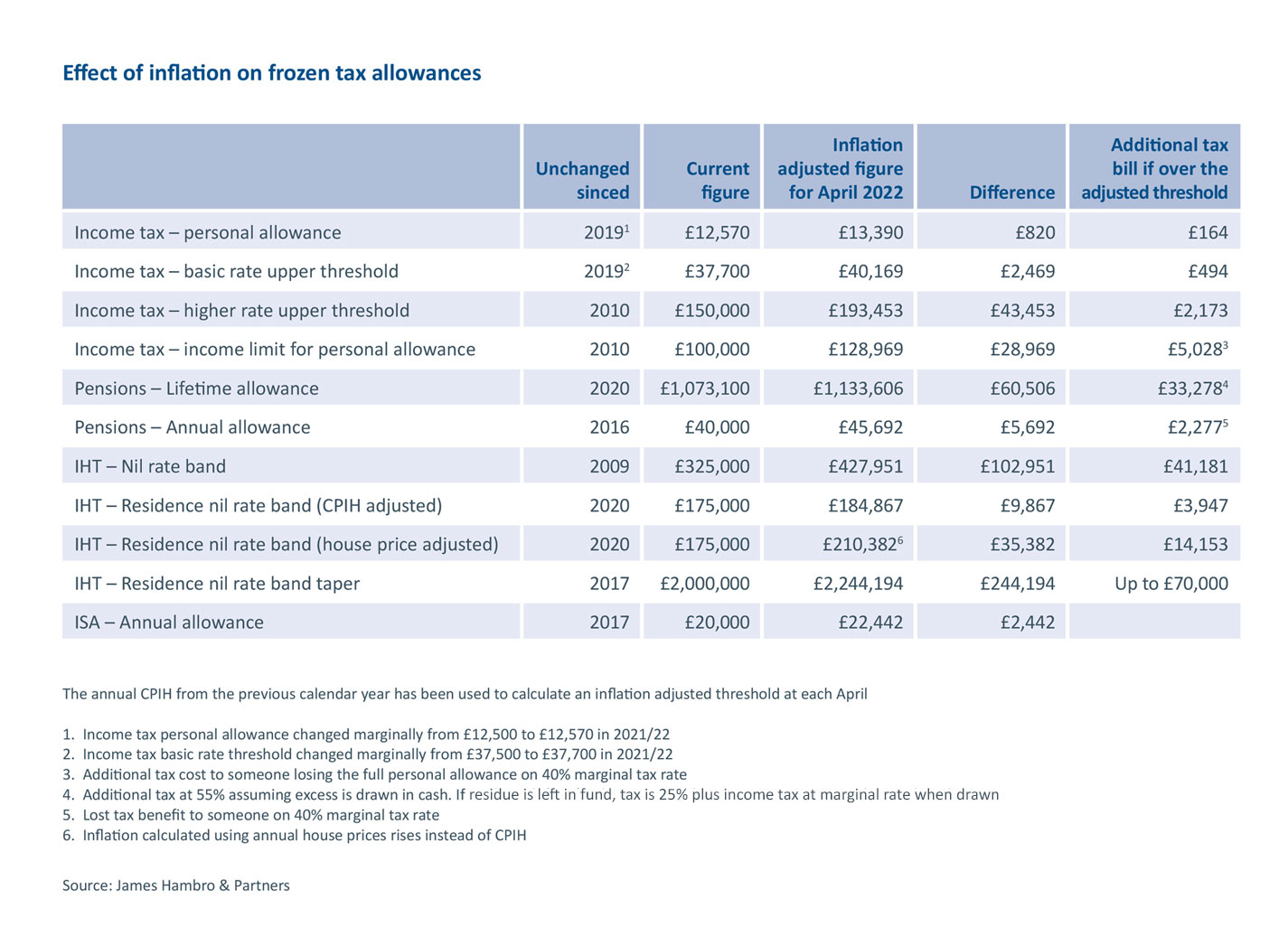

We also can’t forget the effect of the residence nil-rate band taper which cuts the allowance by £1 for every £2 an estate is valued over £2mn

Inflation until recently has been relatively modest, but our research lays out how frozen tax allowances have already eaten away at people’s wealth. By far the worst offender is inheritance tax (IHT). The nil-rate band threshold has been stuck at £325,000 since 2009–10. adjusted for inflation it should have begun this tax year £102,951 higher. The residence nil-rate IHT band meanwhile was frozen more recently at £175,000. It trails prices by £9,867 with no plans for a thaw until at least four years’ time.

Pensions and income tax

The pension lifetime allowance has also fallen victim to stealth taxation. The threshold was frozen in 2020-21. Had it risen in line with inflation it would now be £1,133,606 by our calculations. This could mean an additional tax charge of over £33,000 for those breaching the limits and taking the surplus in cash. And that’s not to mention the contribution taper for high earners or the huge falls in pension contribution limits witnessed over the past two decades.

Take-home pay, too, has been hit by the big freeze. Income tax thresholds have remained in stasis since the end of the last decade costing £164, £494, or £2,173 depending on whether you are a basic, higher, or additional rate taxpayer. The toxic mix of rising wages and frozen thresholds means more people are trapped in the death zone of the 60% marginal tax rate. This is the result of the taper rate introduced in 2010 for those earning over £100,000 – for every £2 you earn over £100,000 you lose £1 of your personal allowance. Had this taper trigger risen in line with inflation, it would start at £128,969 this year.

With good financial planning and smart advice there are ways to mitigate the effects of these freezes.

Top Tip

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets cIpsum.

Lee Goggin

Co-Founder

Maximise allowances

A good adviser will ensure you take best advantage of the available allowances. This is especially important if your estate is going to be hit with a hefty inheritance tax bill.

A good adviser will ensure you take best advantage of the available allowances. This is especially important if your estate is going to be hit with a hefty inheritance tax bill

Often, we might encourage clients to prioritise withdrawing from their general investment accounts and ISAs over pensions as the latter are currently protected from IHT. We suggest clients use their ISA allowance each year to protect money from capital gains and dividend taxes. If you die before your spouse or civil partner, then this money can pass to them within the tax shelter. If you are not using your allowance each year but have existing assets outside a pension or ISA wrapper – in a general account, for example – consider rolling some of this into an ISA to protect it.

Don’t hold too much cash

Those who keep large proportions of their wealth in cash are going to see its value sharply eroded. We tend to recommend keeping no more than two years’ worth of expenditure in your cash savings accounts. If you have had a large amount in cash and are moved to invest it now in the markets but worried about them plunging suddenly, consider building up your investment position over a period of months, drip-feeding your money in gradually rather than all at once, to mitigate the risk of bad timing.

Those who keep large proportions of their wealth in cash are going to see its value sharply eroded. We tend to recommend keeping no more than two years’ worth of expenditure in your cash savings accounts

Think of the children

Once you know exactly how much you need for later life – taking into account inflation – then consider giving some money away to your children or grandchildren now. I counsel clients to resist being over-generous – you don’t want to be a burden on them because you have recklessly weakened your own ability to look after yourself. A good adviser can help you know how much you can afford to give and suggest sensible IHT-friendly ways to do so.

Don’t hoard

Lastly, have fun! I’ve seen too many people carry on working needlessly into later life, only for them or their partner to fall sick soon after they have given up work, leaving them full of regrets about their lost retirement dreams. I have also seen too many friends live within their means when they have retired because they are needlessly anxious about their financial position. One of the benefits of good advice is that you end up with a much better idea of what you can afford to spend. That can give you the freedom to let loose.

You never know what’s going to happen tomorrow, next month, or next year. Learn how to live for today!